As a parent who has taken a break from the workforce, I’ve often thought about returning to school. The question always arises: where should I go, and what should I study? The advertisements for institutions like the University of Phoenix are particularly alluring, showcasing happy students engaged at computers. I admit, I’m a fan of education—I thrived in college and would gladly remain a lifelong learner. However, the choice of institution is crucial when considering long-term financial stability.

For-profit colleges, such as the University of Phoenix, pose significant risks. A recent report by the Brookings Institution highlights the troubling trend of rising student debt associated with these institutions. Researchers Adam Johnson from the U.S. Treasury and Emily Carter from Stanford University found that the number of student loans for for-profit colleges has surged over the past 15 years.

Gina L. Brown, writing for The Observer, emphasizes the alarming rise in debt levels: “In 2000, only one for-profit institution was among the top 25 colleges for student loan debt. By 2014, that number had jumped to 13, with the University of Phoenix leading the pack. The total debt owed by students at for-profit colleges has skyrocketed from $39 billion in 2000 to a staggering $229 billion in 2014.” This increase is largely due to the growing borrowing rates rather than a surge in enrollment.

Moreover, students attending for-profit and community colleges face higher loan default rates compared to those at traditional four-year colleges. Brown states, “Among those who began repaying their federal loans in 2011, only 8% of students from four-year institutions defaulted within two years, while the default rate for non-traditional college attendees was nearly three times higher.”

Several factors contribute to this disparity. For-profit colleges often mislead students about credit transfers, which can force them to take additional, costly courses. They also frequently do not permit students to take breaks, making it challenging for those who wish to work before completing their degree. Additionally, graduation rates at for-profit colleges are alarmingly low, with only 49% of students completing their degrees compared to 70% at traditional institutions.

The situation worsens with inflated job placement statistics, leaving graduates struggling to find well-paying jobs. Reports from Mia Thompson at Vox indicate that “unemployment rates for graduates of for-profit colleges reached as high as 21%, compared to 17% for community college graduates. Even those who secured employment earned a mere $21,000 annually.” If a for-profit college closes before a student graduates, they are left with significant debt and no degree.

On a brighter note, college enrollment spikes during economic downturns, suggesting that as the economy improves, default rates may decrease. Personally, I plan to satisfy my educational ambitions with a few selective courses. However, for my children, who will soon be considering their college options, the lesson is clear: prioritize traditional four-year institutions and resist the allure of for-profit colleges.

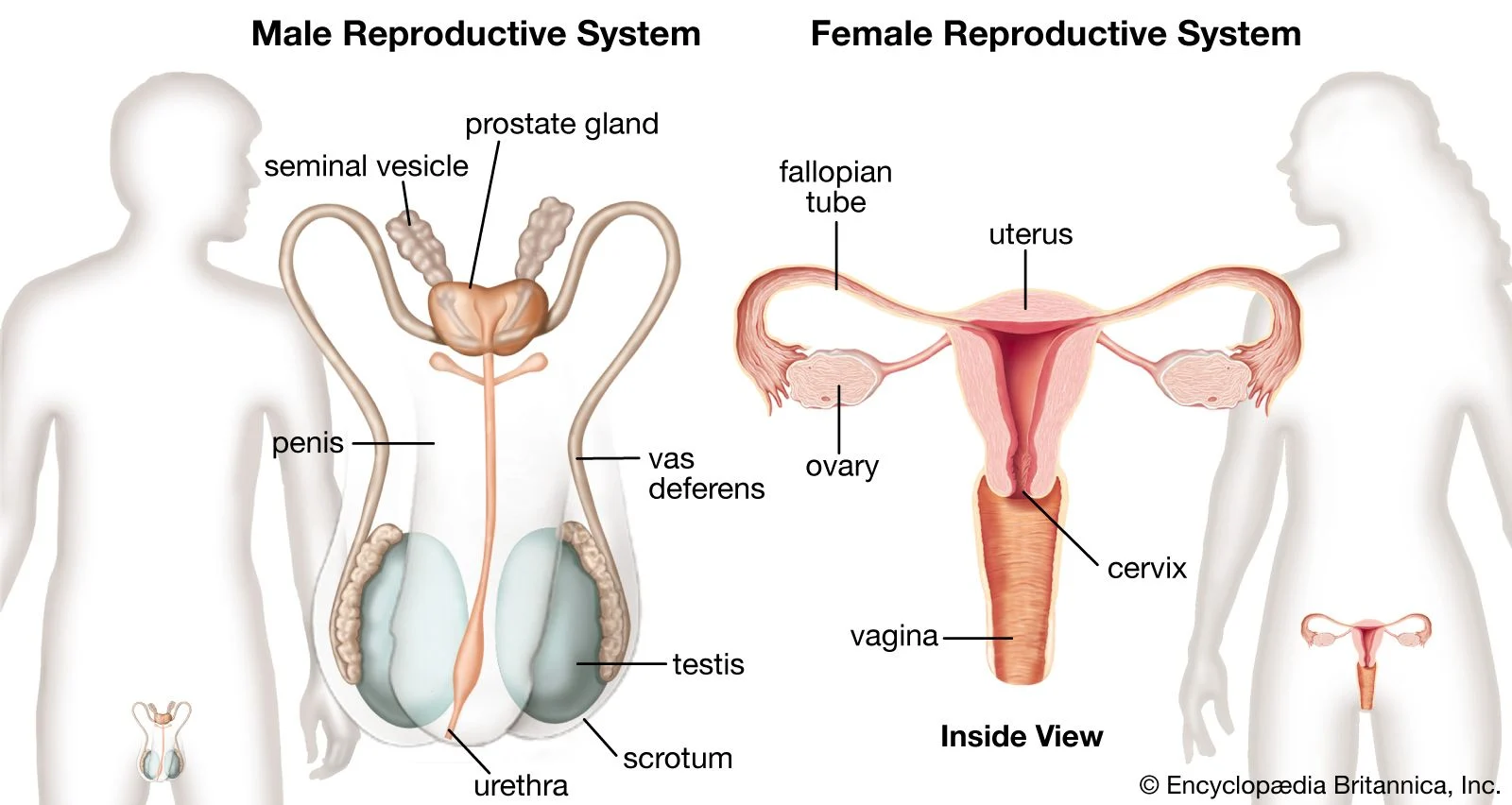

For those interested in expanding their knowledge, be sure to check out this insightful resource on home insemination kits. Additionally, for expert guidance, visit Millie’s FAQ for authoritative answers on related topics and consider exploring this excellent resource for pregnancy and home insemination information.

In summary, as you navigate educational choices for your children, remember to steer them away from for-profit colleges, where the risks often outweigh the benefits. Focus on institutions that provide a better chance of success and financial stability.