Summary:

In vitro fertilization (IVF) has become a popular and effective method for couples struggling with infertility to conceive a child. However, this advanced fertility treatment comes with a hefty price tag, making it a difficult decision for many couples. In this blog post, we will explore the financial realities of IVF and provide important information that can help couples make an informed decision about pursuing this treatment.

First and foremost, it is important to understand that IVF is an expensive process. The average cost of a single IVF cycle can range from $12,000 to $15,000, and many couples require multiple cycles to achieve a successful pregnancy. This cost includes various aspects of the treatment such as medications, lab work, and procedures. In addition, there are additional costs such as genetic testing and frozen embryo storage, which can add thousands of dollars to the overall cost.

One of the biggest factors that contribute to the high cost of IVF is the need for multiple cycles. It is estimated that only 30% of IVF cycles result in a successful pregnancy, meaning that many couples will have to go through multiple cycles to achieve their desired outcome. This can quickly add up to tens of thousands of dollars, putting a significant financial strain on couples.

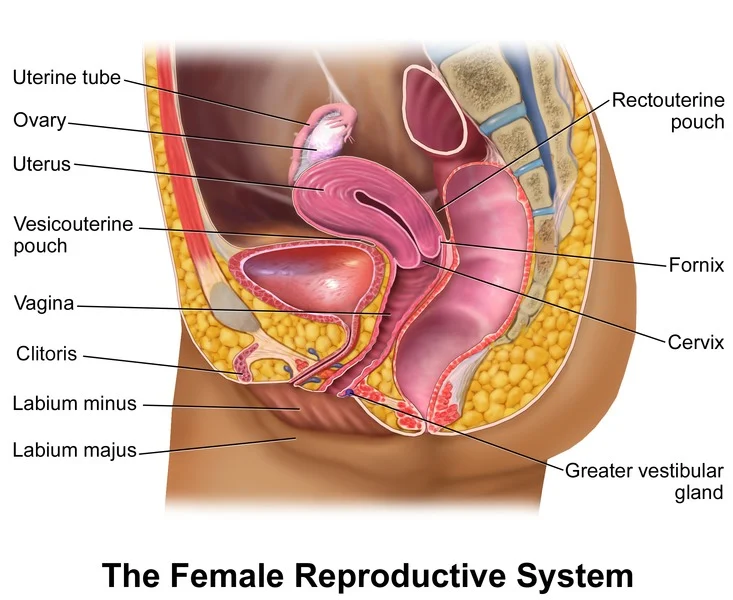

Another important aspect to consider is the cost of medications. IVF requires a series of hormone injections to stimulate the ovaries and increase the chances of successful egg retrieval. These medications can cost anywhere from $3,000 to $6,000 per cycle, depending on the type and dosage required. In some cases, insurance may cover a portion of these costs, but many couples end up paying out of pocket.

Aside from the direct costs of IVF, there are also indirect costs that couples should be aware of. These include the cost of time off from work for appointments and procedures, travel expenses for out-of-state treatments, and the emotional toll that IVF can take on couples. All of these factors should be considered when making the decision to pursue IVF.

The Financial Realities of In Vitro Fertilization

It is also important to acknowledge that success rates for IVF vary based on a variety of factors such as age, health, and underlying causes of infertility. While the average success rate for IVF is around 30%, this percentage decreases significantly for women over 35 years old. This means that older couples may need to undergo more cycles to achieve a successful pregnancy, resulting in higher costs.

So what can couples do to manage the high financial burden of IVF? The first step is to educate yourself about the costs and potential outcomes of the treatment. Many fertility clinics offer financing options or payment plans to help make IVF more affordable. It is also recommended to research and compare prices of different clinics, as costs can vary significantly.

Another option is to explore insurance coverage for fertility treatments. While not all insurance plans cover IVF, some may cover certain aspects such as medications or diagnostic tests. It is important to carefully review your insurance policy and speak with your provider to understand what is covered.

Additionally, couples can consider alternative methods of financing such as using personal loans, crowdfunding, or grants specifically for fertility treatments. These options may require some research and effort, but they can help alleviate some of the financial burden of IVF.

In conclusion, while IVF can be a life-changing treatment for couples struggling with infertility, it is important to understand and prepare for the financial realities that come with it. By being informed and exploring different financing options, couples can make the best decision for their individual situation and increase their chances of a successful outcome.

5 Probable Search Queries:

1. “How much does IVF cost?”

2. “What are the financial realities of IVF?”

3. “Is IVF covered by insurance?”

4. “How can I finance IVF treatment?”

5. “What are the success rates for IVF?”