In the United States, the reality of financial hardship is more prevalent than many realize, with almost 51 million households grappling to afford basic necessities like rent, food, and transportation. According to the United Way’s ALICE Project, this represents around 43 percent of the population—nearly half of American families are living paycheck to paycheck. The term ALICE stands for Asset Limited, Income Constrained, Employed, highlighting that many families with at least one employed parent still face significant economic challenges.

These individuals are often overlooked when discussing poverty; they might be your local childcare worker, a cashier at a supermarket, or a home health aide. As the United Way notes, ALICE families typically find themselves struggling to pay bills, lacking savings, and making difficult choices, such as whether to afford quality child care or pay their rent. An unexpected expense, like a car repair or medical bill, can easily push them further into financial distress.

The 43 percent statistic includes approximately 34.7 million ALICE families and 16.1 million households living below the poverty line, as reported by CNN. While ALICE families technically earn above the poverty threshold, they still cannot sustain their basic needs. The ALICE Project, which began as a pilot study in New Jersey, has expanded to encompass data from 16 states.

Despite some positive indicators in the economy, such as unemployment rates dropping below 4 percent for the first time since 2000, the ALICE Project director, Stephanie Hoopes, emphasizes that financial difficulties continue to be a significant issue. The people affected by these disparities often hold jobs that society heavily relies on, such as child care providers. Many of these workers, like those in my own experience as a nanny, face the challenge of balancing low wages with the high cost of living.

For instance, while I was employed as a nanny, I was fortunate not to have to pay rent since my child and I lived with my parents. However, finding families willing to pay my asking rate was difficult, leading me to take lower-paying positions. Most of my earnings went toward transportation, which was often a lengthy commute since many jobs were not within walking distance. Public transportation can be costly, and without a car, I was spared the expenses of gas, tolls, and parking. Furthermore, during my travels, I often relied on fast food for meals, as not all families I worked for had facilities to prepare food.

The issue of low wages extends to service industry jobs, with a significant portion of workers earning less than $20 an hour. CNN reports that around 66 percent of jobs fall below this wage, and even as states aim to increase their minimum wage to $15, the reality is that many workers will still struggle to keep pace with living costs. For instance, in King County, Washington, a family of four would need to earn $43 an hour just to meet basic needs, while only 14 percent of jobs in the area offer that level of compensation.

These families often depend on government assistance programs like Medicaid and SNAP, yet they face stigma from those who deem their jobs less important. However, it is essential to recognize that these workers are the backbone of our society—the individuals who provide essential services that many take for granted. Without them, the daily conveniences we enjoy would not be possible.

In summary, nearly half of American households are struggling to afford basic necessities, despite having jobs. The ALICE Project sheds light on the financial hardships faced by everyday workers, emphasizing the need for a reevaluation of wages and support systems. Everyone deserves the ability to meet their basic needs, and understanding these challenges is the first step towards fostering a more equitable society.

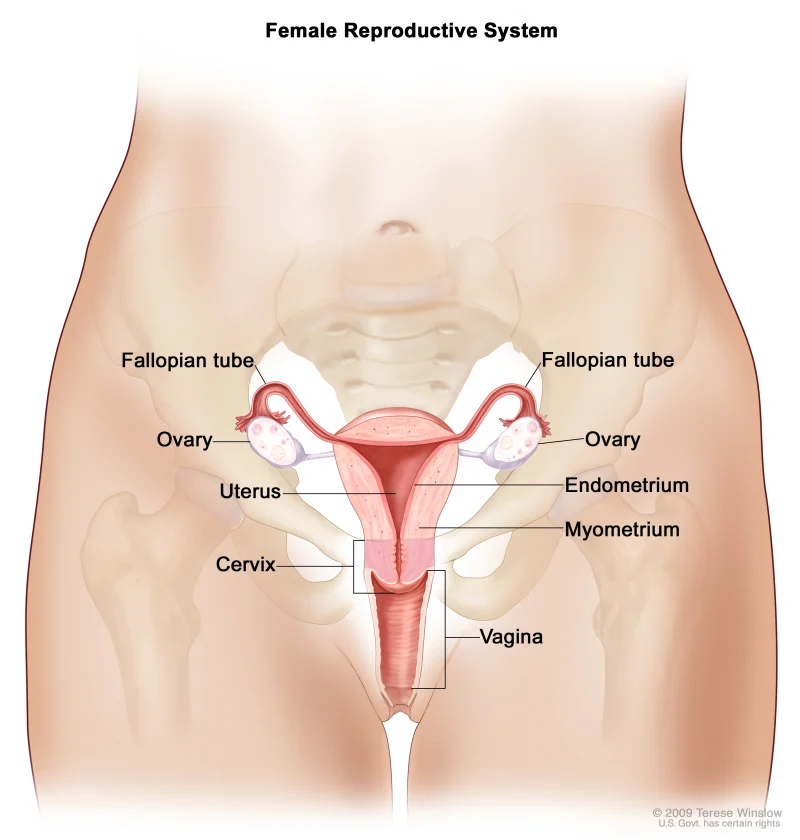

For those interested in further exploring topics related to family planning and artificial insemination, check out this blog post, which offers valuable insights. Additionally, for expert knowledge, visit Intracervical Insemination and WebMD for comprehensive resources.