In a move that has left many educators disheartened, the recent tax legislation pushed through by the GOP has eliminated the tax deduction that teachers previously relied on for purchasing classroom supplies. This bill, hastily drafted and passed in the dead of night, has garnered significant criticism for its prioritization of wealthier Americans over teachers and other essential workers.

Under the previous law, teachers could deduct up to $250 from their taxes to offset the costs of supplies that they often purchase out of pocket. However, this deduction will vanish under the new tax framework, as reported by various sources. Representative Jane Thompson from Florida voiced her concerns on social media, stating, “While corporations continue to benefit from tax deductions, educators who invest their own money to support their students are left with nothing.”

The National Education Association has also expressed its dissatisfaction with the legislation. NEA President Sarah Johnson remarked, “As teachers increasingly cover the costs of basic supplies, it’s disappointing that lawmakers would disregard the efforts of those dedicated to nurturing our students.”

The implications of this change are profound, especially when considering that a 2013 study found that teachers spend nearly double the deduction amount on classroom materials each year—around $485. This adjustment further undermines educators, who are already facing financial challenges in providing quality education.

While the tax bill offers significant breaks to high-income earners and businesses, it neglects the fundamental needs of teachers. This situation is exacerbated by stories of educators, such as one from Oklahoma, who had to resort to begging for funds to equip her classroom.

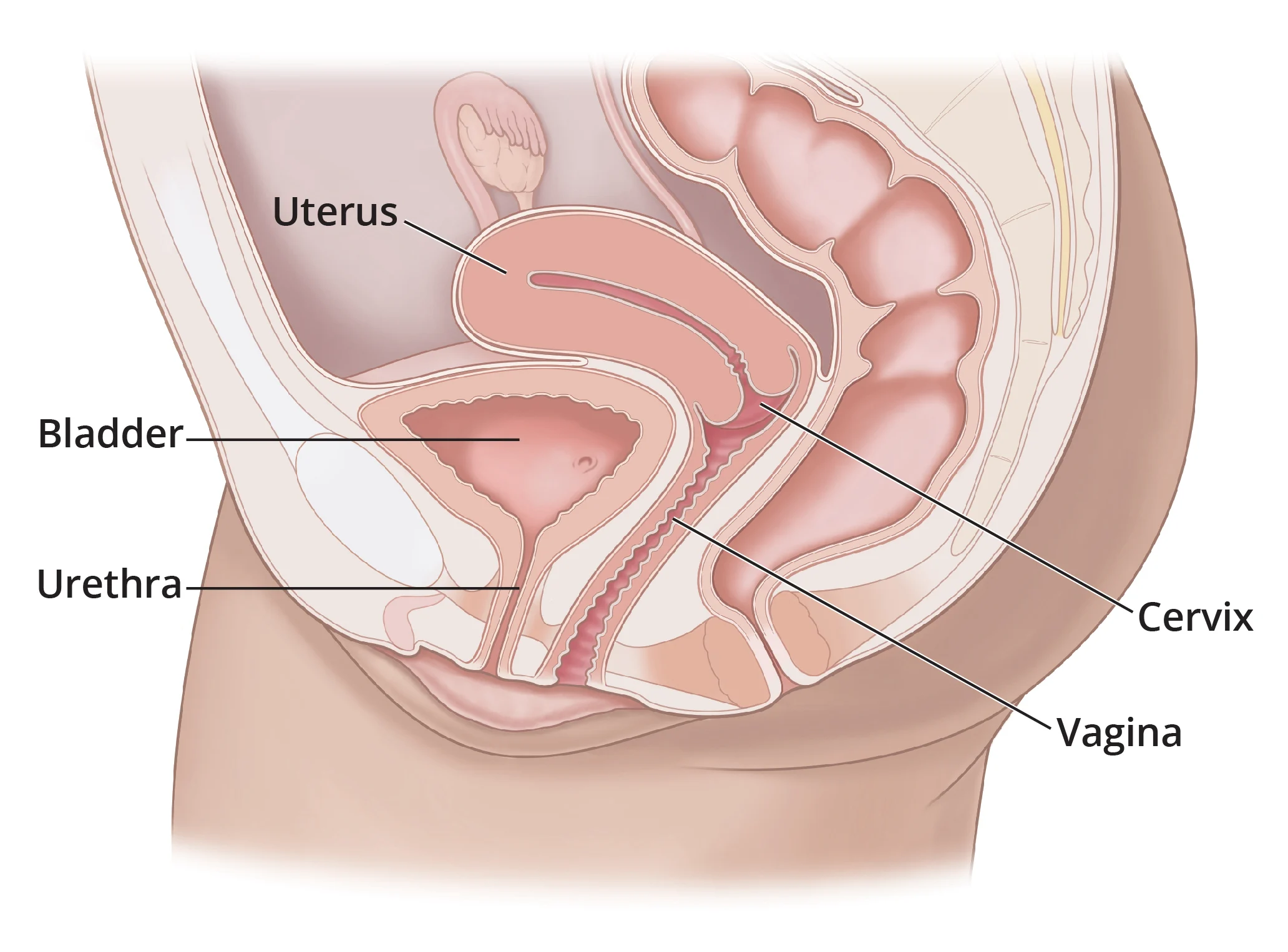

For those interested in exploring different aspects of family planning and insemination, check out this post on making the most of your couples fertility journey through intracervical insemination. Additionally, if you’re curious about the prospects of conceiving quickly, Expecting After Just Three Months provides insightful information on achieving success in your efforts. For a broader understanding of fertility and related topics, Medical News Today is an excellent resource.

In summary, the removal of the tax deduction for teachers is a troubling development that reflects a broader trend of neglecting the needs of educators in favor of corporate interests. As teachers continue to invest their resources for the benefit of their students, this legislation represents yet another hurdle in their already challenging profession.