Managing family finances can be challenging, but the right budgeting apps can provide the support you need to stay on track. Whether you’re navigating everyday expenses or planning for the future, these parent-approved tools can help you gain a clear understanding of your financial situation.

How We Selected the Best Budgeting Apps for Families

When I first started tracking my family’s spending, it was after we found ourselves in a less-than-ideal financial situation. Establishing a budget was crucial; it prevented us from falling into debt during tough times. Though budgeting takes effort and dedication, there are plenty of apps available that can simplify the process.

Budgeting is beneficial not just for those facing financial difficulties. As financial expert Anna Thompson emphasizes, having a budget provides clarity about where your money goes each month. You’ll be able to see the proportion of your income spent on essential costs like housing, childcare, groceries, and utilities. This insight allows you to identify how much is left for enjoyable activities, like your children’s extracurriculars.

Moreover, budgeting is about future planning. Financial educator Mark Robinson points out, “Families encounter distinct financial hurdles, from managing daily expenses to preparing for future needs like education and retirement.” A budget serves as a navigational tool, guiding families through their financial journey and helping them avoid unexpected pitfalls.

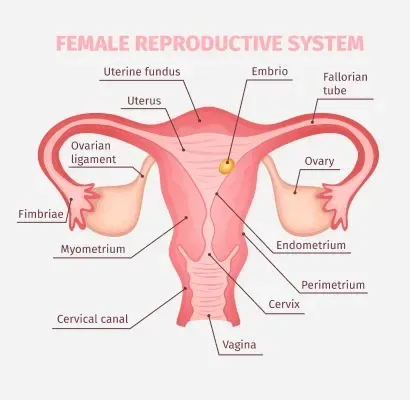

To assist in your financial planning, consider checking out resources like this excellent site on pregnancy and home insemination which delves into various aspects of family planning. If you’re considering at-home insemination, tools such as the Impregnator at Home Insemination Kit can also help. Additionally, you can find information on your due date at this reputable source.

In summary, budgeting is a crucial component of financial health for families. By utilizing these apps, you can gain control over your finances, ensure you’re prepared for both immediate and long-term needs, and ultimately achieve your family’s financial goals.