Planning for Parenthood: The Financial Considerations of Self-Insemination

Parenthood is a journey that many people dream of and plan for. However, for some individuals or couples, the traditional methods of becoming parents may not be an option. This is where self-insemination comes into play. Self-insemination is the process of using a sperm donor to fertilize an egg at home, without medical assistance. This method allows individuals or couples to have a biological child without the high costs and procedures involved in traditional fertility treatments. While self-insemination can be a more affordable option, there are still financial considerations to take into account when planning for parenthood in this way.

1. Cost of Sperm Donor

The first financial consideration when planning for self-insemination is the cost of a sperm donor. There are various options for obtaining sperm, such as using a known donor or purchasing sperm from a sperm bank. If using a known donor, the cost may be minimal or even free. However, using a sperm bank can cost anywhere from a few hundred to a few thousand dollars, depending on the quality and quantity of sperm purchased. It is important to research and compare different sperm banks to find the best option for your budget.

2. Legal Fees

While self-insemination may seem like a simple process, it is important to seek legal advice before proceeding. This is particularly important if using a known donor, as there may be legal implications and responsibilities to consider. Legal fees can vary, but it is important to budget for this expense to ensure that all parties involved are protected and aware of their rights and responsibilities.

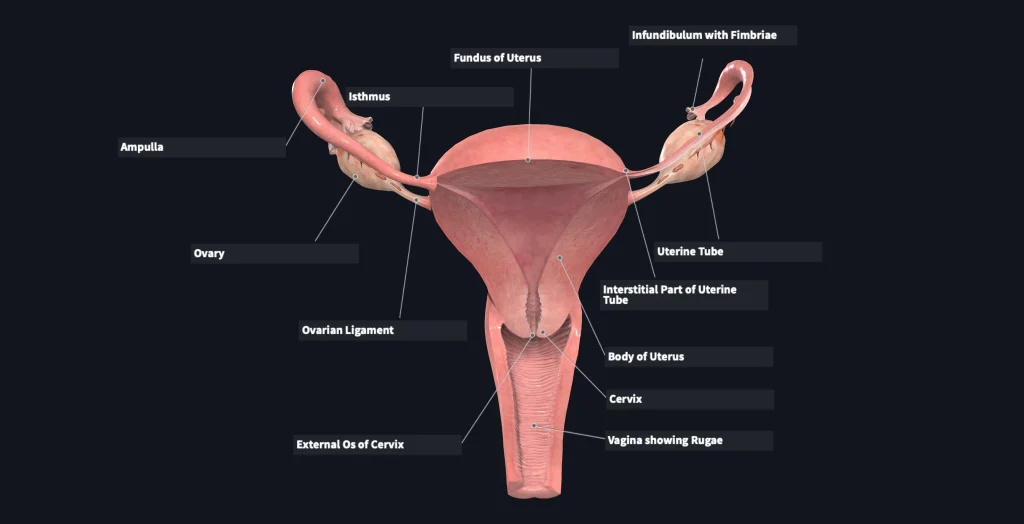

3. Fertility Tracking and Supplies

In order to increase the chances of a successful self-insemination, fertility tracking is essential. This involves tracking ovulation cycles and using ovulation prediction kits to determine the best time for insemination. These kits can range from $20 to $50, depending on the brand and quantity. Additionally, there are other supplies needed for the process, such as sterile syringes and cups, which may also add to the overall cost.

Planning for Parenthood: The Financial Considerations of Self-Insemination

4. Pregnancy and Childbirth Expenses

Once the self-insemination is successful, there will be additional expenses to consider during pregnancy and childbirth. This may include prenatal care, ultrasounds, and delivery costs. It is important to factor in these expenses when budgeting for self-insemination, as they can add up quickly.

5. Parental Leave and Childcare Costs

Another financial consideration to keep in mind is parental leave and childcare costs. If you or your partner plan to take time off work to care for the child, it is important to consider the loss of income during this time. Additionally, childcare costs can be significant, so it is important to research and budget for these expenses as well.

6. Insurance Coverage

It is important to check with your insurance provider to see if self-insemination and any associated costs are covered under your plan. While some insurance plans may cover fertility treatments, they may not cover self-insemination. It is important to have a clear understanding of what is covered under your plan to avoid any unexpected expenses.

7. Emergency Funds

As with any major life change, it is important to have emergency funds in place. Unexpected expenses may arise during the process of self-insemination, pregnancy, and raising a child. Having a savings account or emergency fund can help alleviate financial stress and provide a safety net for any unexpected costs.

In conclusion, while self-insemination may be a more affordable option for parenthood, it is still important to carefully consider the financial implications. It is essential to budget and plan for all expenses associated with self-insemination, pregnancy, and raising a child. Seeking professional advice, researching costs, and having emergency funds in place can help ensure a smoother and more manageable journey towards parenthood.