Fertility Financing: Exploring the Financial Side of Self-Insemination

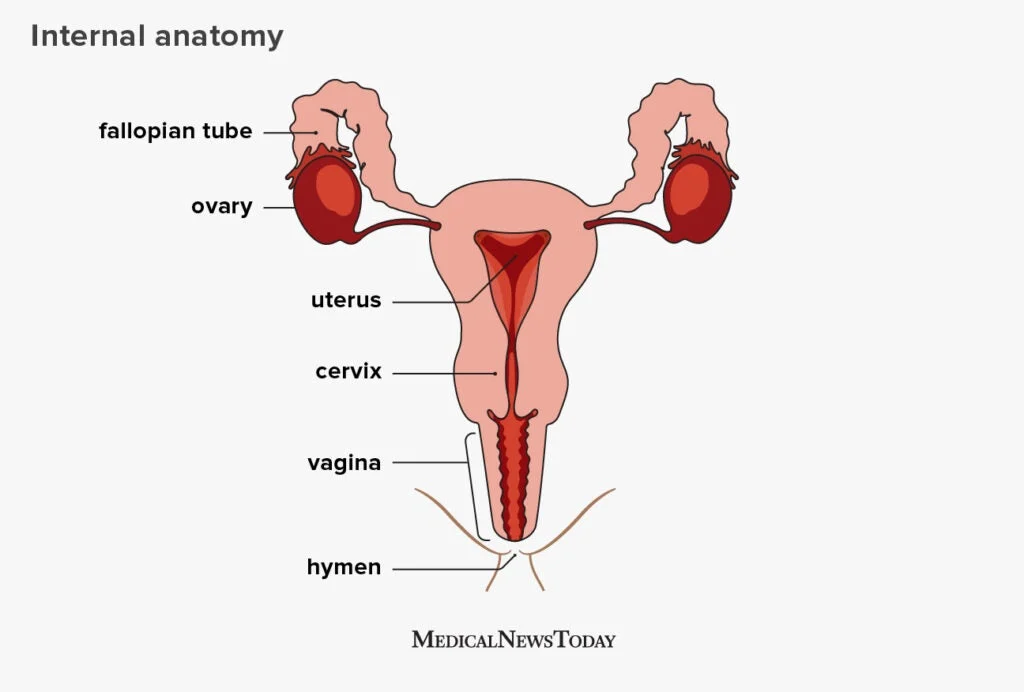

When it comes to starting a family, there are many options available for couples and individuals who are unable to conceive naturally. One of these options is self-insemination, which involves using a home insemination kit to insert sperm into the vagina without the assistance of a medical professional. While self-insemination can be a more affordable and convenient option for those looking to start a family, there are still financial considerations to keep in mind. In this blog post, we will explore the financial side of self-insemination and discuss fertility financing options that can help make this process more accessible.

1. What is self-insemination and why is it becoming a popular option?

Self-insemination is a method of assisted reproduction that involves using a home insemination kit to insert sperm into the vagina. This process can be done with the help of a partner or using a donor’s sperm. With the rising costs of fertility treatments, self-insemination has become a popular option for those looking to start a family. It is more affordable and can be done in the comfort of one’s home, making it a more convenient option for many individuals and couples.

2. How much does self-insemination cost?

The cost of self-insemination can vary depending on the method used and the type of insemination kit chosen. On average, a home insemination kit can cost anywhere from $50 to $200. This cost includes the necessary supplies such as sperm collection cups, syringes, and ovulation predictor kits. It is important to note that additional costs may be incurred if the sperm is purchased from a sperm bank or if professional medical consultations are needed.

Fertility Financing: Exploring the Financial Side of Self-Insemination

3. What are the other financial considerations to keep in mind?

Aside from the cost of the home insemination kit, there are other financial considerations to keep in mind when opting for self-insemination. These include the cost of fertility tests and consultations, potential travel expenses if using a donor’s sperm, and the cost of prenatal care and delivery once pregnancy is achieved. It is important to create a budget and plan accordingly to ensure that all costs are covered.

4. How can fertility financing help with the cost of self-insemination?

Fertility financing is a great option for those who are considering self-insemination but are worried about the costs involved. Many fertility clinics and organizations offer financing options such as payment plans and loans to help individuals and couples afford fertility treatments. It is important to research and compare different financing options to find the best one for your individual needs.

5. What are some other ways to save on the cost of self-insemination?

There are a few ways to save on the cost of self-insemination. One option is to look for discounts or promotions on home insemination kits. Some clinics and organizations also offer discounted prices for bulk purchases of sperm. Additionally, some insurance plans may cover the cost of fertility treatments, so it is worth checking with your insurance provider to see if this is an option for you.

In conclusion, self-insemination can be a more affordable and convenient option for those looking to start a family. However, there are still financial considerations to keep in mind. By researching fertility financing options and creating a budget, individuals and couples can make self-insemination a more accessible and manageable option for their family planning journey.