When my partner, Alex, and I started our journey together, we had some deep conversations about our future. While Alex had reservations about having more children beyond the one he had from a previous relationship, he was open to the idea of creating a family with me. I was thrilled to discover how much he cherished his child, and we eagerly discussed ways to incorporate her into our new lives.

When we broached the subject of finances, the excitement of opening a joint bank account was palpable. I couldn’t believe I had found someone as understanding and inclusive about money as I was. It felt incredible to have a partner willing to combine our finances for a common goal. Neither of us had experienced true financial partnership in our past relationships, which made this agreement feel promising.

However, there was one crucial detail we overlooked: we both had lingering consumer and student loan debt from difficult periods in our lives. By the time we felt comfortable enough to share our financial histories, I was already expecting our first child. True to our commitment as partners, we decided to tackle our debts together.

I later learned that our situation had a rather unfortunate label: “inherited debt.” Alex’s low credit score has made it difficult for us to secure reasonable car loans, while my score has complicated our apartment search. Essentially, we unintentionally took on each other’s financial burdens, and we would have to navigate this challenge together until we could overcome it.

I initially thought we were alone in this struggle until I came across a compelling survey by Finder.com. The results revealed that 1 in 6 Americans are burdened with “inherited debt,” often stemming from a current or former partner. The reasons vary widely, including marriage, joint purchases, divorce settlements, and even the death of a loved one. Inherited debt often includes everything from credit cards to student loans, with medical bills and personal loans also being common culprits.

The survey highlighted that, for those who have taken on a partner’s debt, the average amount adds up to $23,238. In a striking comparison, sexually transmitted infections account for about $16 billion in healthcare costs annually, while Americans share a staggering $921 billion in debt accrued through poor spending habits.

I completely understand why the surveyors link overspending to unsafe practices, but it’s a hard reality to face for someone who never meant to end up in this financial predicament. I also empathize with those who suffer from financial abuse, where a partner’s reckless spending can wreak havoc on one’s credit. But what about couples like us, who genuinely strive to do right by each other and still find themselves dealing with this burden?

It’s easy to judge those who hide debts from their partners. But when you dig deeper, you realize there might be more at play. Alex comes from humble beginnings and has faced numerous obstacles. When he finally chose to pursue college at 26, he was already balancing the responsibilities of fatherhood and a troubled marriage. With little money for school, he took out substantial loans, unaware that his college was a for-profit institution that would later be sued for fraud.

All Alex wanted was to carve out a career path, support his growing family, and find pride in his accomplishments. Like many, he didn’t fully grasp the long-term implications of his student loans, especially since he lacked the financial means to attend college without them.

After a painful separation from my first husband, I found myself living in a tiny studio, struggling to make ends meet. I had always feared credit cards, having witnessed their detrimental effects on my mother’s life. I spent years avoiding them, only to eventually cave under pressure and accumulate several lines of credit that I was ill-prepared to manage. When I finally confided in Alex about my debts, I was overwhelmed by his compassion.

Given my own student loan burdens, I understood the shame Alex felt when he revealed his financial troubles. We were both young adults who had no real understanding of the implications of borrowing money for education. Unfortunately, we both ended up in similar situations.

Our “inherited debt” continues to cast a shadow over our lives, causing us stress and anxiety. Thankfully, we approach financial discussions as a united front, which helps when the weight of our situation feels too much to bear.

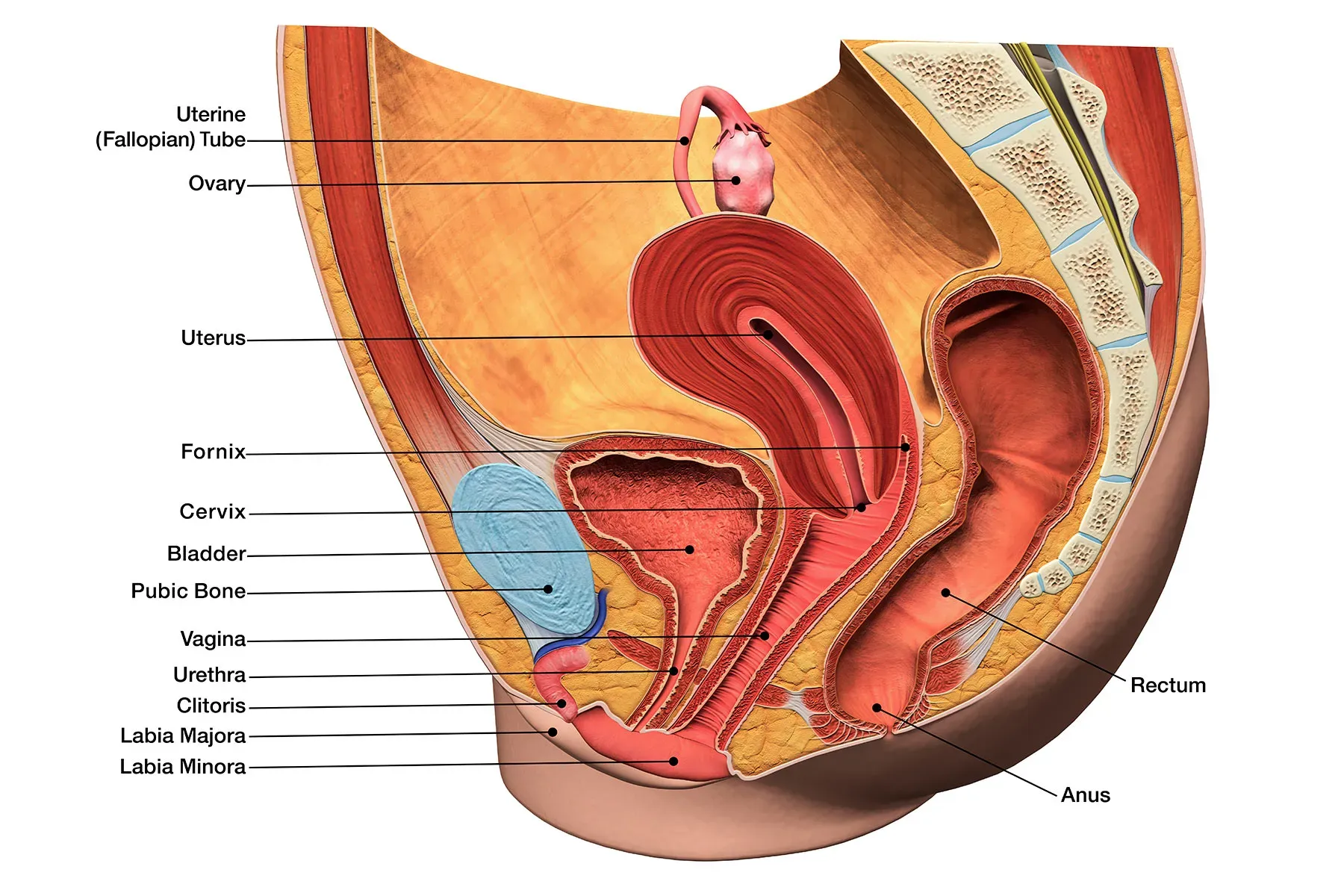

It’s essential to talk openly about finances—just like we should discuss personal health matters—to avoid misunderstandings and build a healthier relationship. In our society, both money and sexual health are often stigmatized, leading to harmful secrecy. We need to create supportive environments where financial education is prioritized, providing accessible resources for managing debt.

If I had been given proper financial guidance and a positive example in my upbringing, I might not be facing these challenges today. However, I recognize the struggles my parents endured in their own lives. To break the cycle of shame surrounding financial matters, it starts with us modeling openness and understanding for our children as we learn to navigate our finances together.

For more on this topic, you can check out this excellent resource for pregnancy and home insemination and learn about other essential aspects of financial responsibility as a couple.

Summary

This article explores the concept of “inherited debt” within relationships, highlighting the common struggles couples face when dealing with financial burdens from past partnerships. Through personal experiences, it emphasizes the importance of open communication about finances and the need for better financial education to break cycles of shame and secrecy surrounding money management.